Product Design

Claro pay start

Real banking autonomy with parental oversight that builds trust, not surveillance.

Year:

2022-2023

Industry:

Finance

Client:

Claro

Project duration:

10 months

Overview

In Brazil, 71% of young people lack financial education. Existing digital tools oversimplified or lacked depth, achieving only 12% retention after 30 days.

Claro pay start combines gamification with real banking (Pix, cards, accounts) to teach financial literacy across developmental stages, ages 4-17.

MY ROLE

Lead UX/UI Designer across research, strategy, content, and interface design.

Context

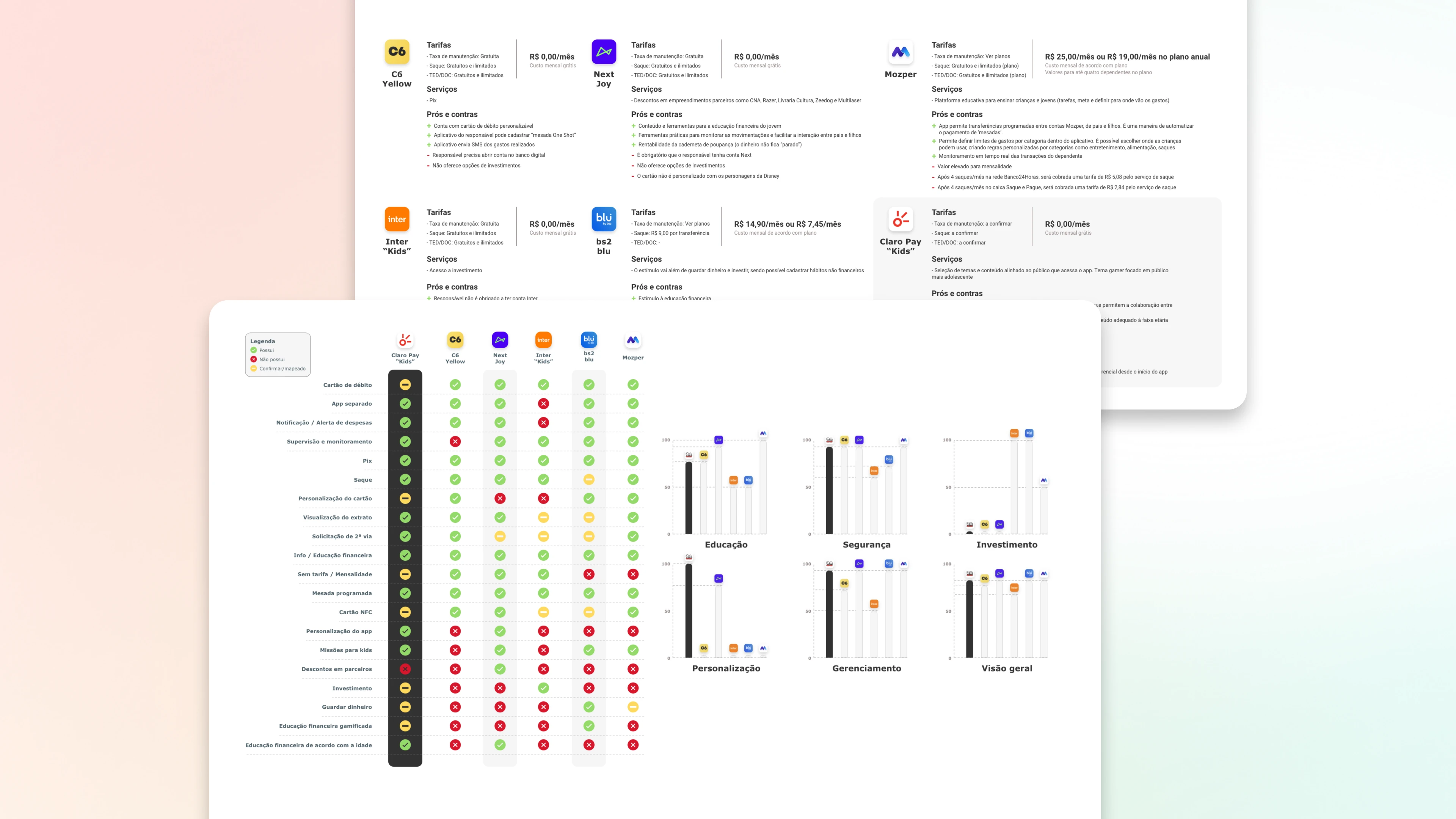

THE LANDSCAPE

Making complex financial concepts comprehensible across ages 4-17 with different developmental stages.

Parents feared surveillance would damage trust yet needed oversight of real transactions

Gamification must teach, not trivialize financial concepts

Integrate Pix, cards, and accounts safely across all age groups

RESEARCH INSIGHTS

Research with 24 parents and 32 children/teens revealed three insights:

Developmental gap matters. Children need immediate visual rewards and simple language. Teens need real autonomy and reject playful aesthetics. One-size-fits-all fails both.

Trust requires transparency, not surveillance. Parents need gradual control as children mature, but constant monitoring damages family trust.

Learning needs context. Users learn by doing, not through disconnected theory. Every transaction becomes a teaching moment.

The solution

STRATEGIC DECISIONS

Age-adaptive architecture. Distinct interfaces scale with developmental stages. Children get visual rewards and simplified language. Teens get direct controls and customization.

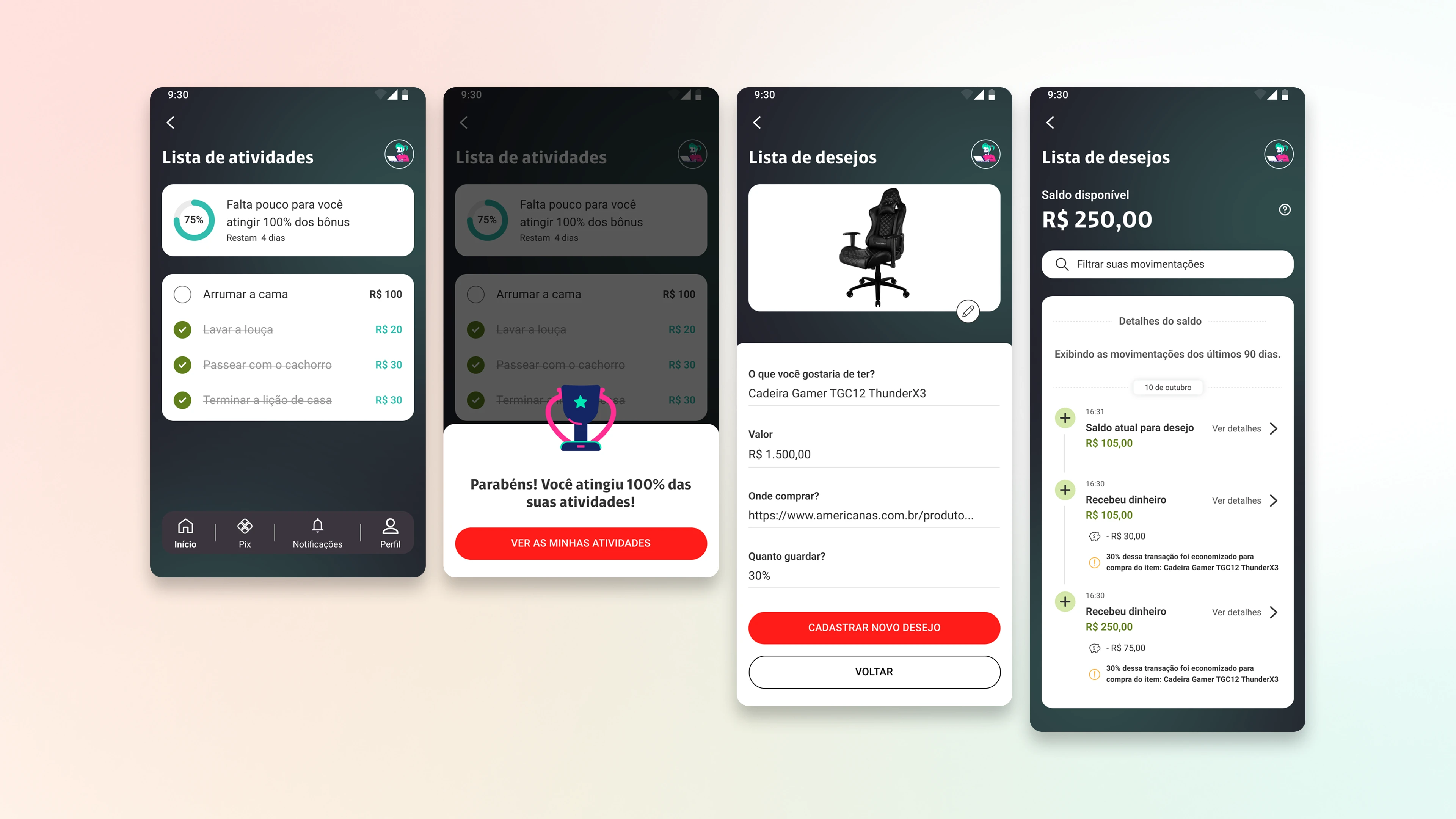

Progressive education system. Five age-adapted levels: Save → Set Goals → Invest → Avoid Waste → Share. Each level connects actionable challenges to real transactions.

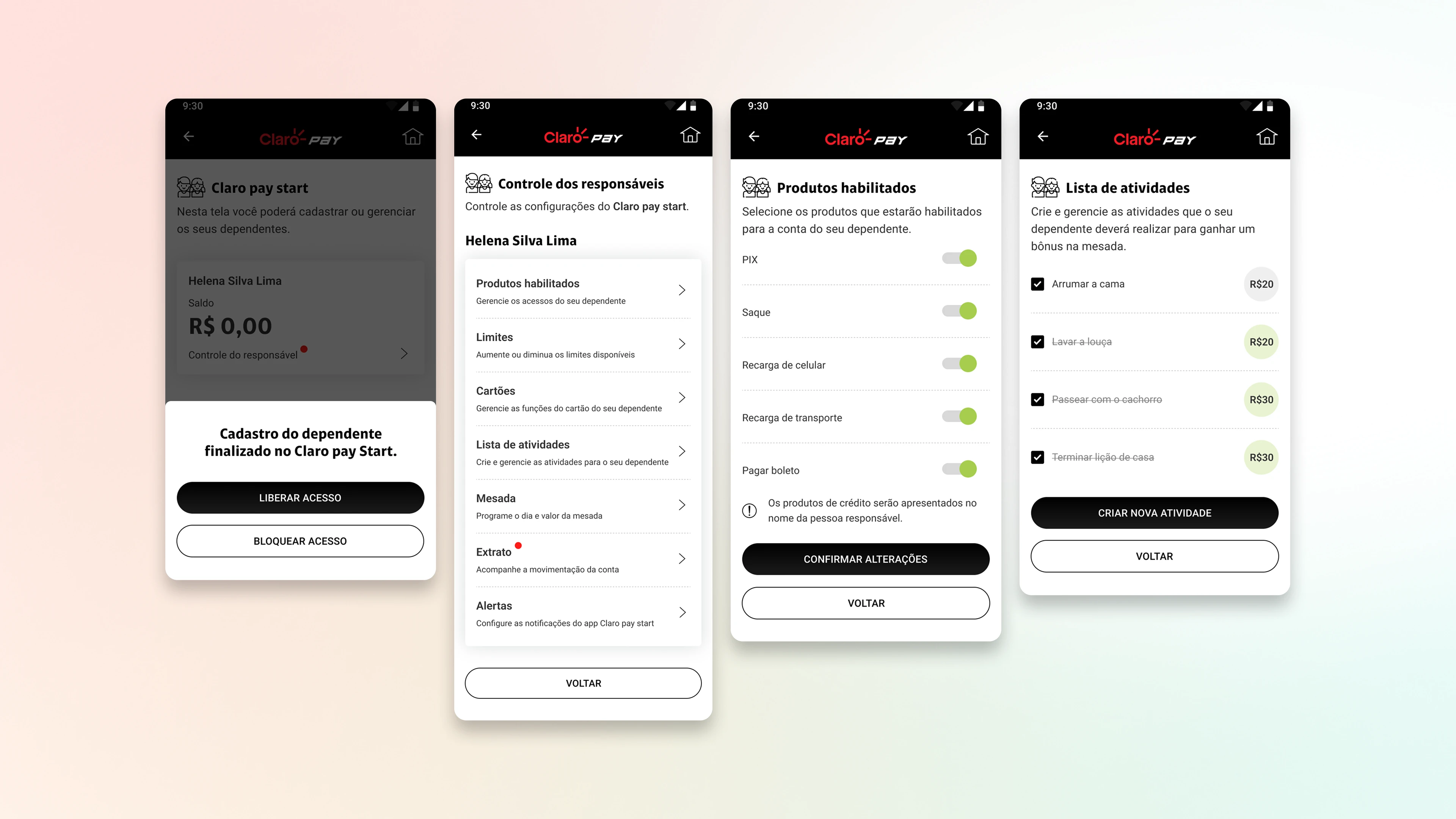

Trust-based parental controls. Initial prototype sent push notifications for every transaction. Testing feedback: "This feels like spying." Pivoted to opt-in dashboard with transaction overview, not surveillance. Controls scale with child maturity.

Genuine rewards over empty badges. Claro ecosystem benefits (streaming vouchers, cloud storage, gaming discounts) reinforce education and create cross-sell opportunities.

CORE FEATURES

Pix flow with 4 visual options and educational tooltips

Goals with visual progress (illustrations fill as savings grow)

Parental dashboard: transaction history and spending insights

Dual challenges: active and historical achievements

MVP (MINIMUM VIABLE PRODUCT)

Onboarding with age verification and parental setup

Pix transfers with educational tooltips

First 2 educational levels with foundational challenges

Parental dashboard with transaction history

Goals with visual progress tracking

Key Learnings

Education cannot be cosmetic. Badge systems felt hollow in testing. Users valued challenges only when tied to genuine content and tangible benefits. Gamification without substance backfires."

Parents want oversight, not surveillance. Constant notifications felt invasive. Opt-in dashboard increased trust and acceptance without children feeling watched.

Language shapes financial stigma. Microcopy testing: "Ask for money" outperformed "Request allowance" 2x (less formal). "Your money is growing" beat "150% CDI yield" by prioritizing comprehension over technical accuracy.

Narrative transforms gamification. "Make 5 Pix transfers" had low completion. Reframed as "Social network fan: share 1 achievement" increased completion 38%.

Adaptation scales with maturity. Treating 4-year-olds and 17-year-olds identically fails both. Success required adaptive language, progressive complexity, and personalization giving teens interface control.

Expected Outcomes

QUANTITATIVE IMPACT (Internal Testing + Pilot)

87% parental approval on controls and transparency (target: 75%)

43% increase in 60-day retention vs. 12% market average

5.2 challenges completed per active user in first month

72% reached Level 2 within 45 days (expected: 50%)

89% satisfaction on Pix transaction usability

NPS 4.6/5 among young users vs. 3.8 market average

BUSINESS IMPACT

Positioned Claro as Brazil's educational fintech pioneer, driving 23% parent conversion to full accounts. First Brazilian solution combining gamification, real banking, education, and parental supervision.

BEHAVIORAL CHANGE

Parents reported unprompted questions about interest rates and investment. 31% reduction in blocked transactions showed users learning limits, not testing boundaries.